Gold Prices Have Doubled: What’s Driving the Surge—and What’s Next?

본문

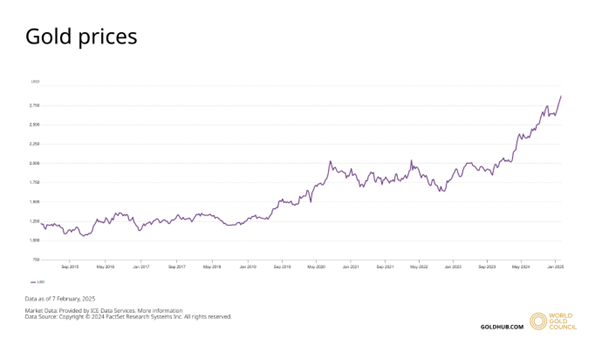

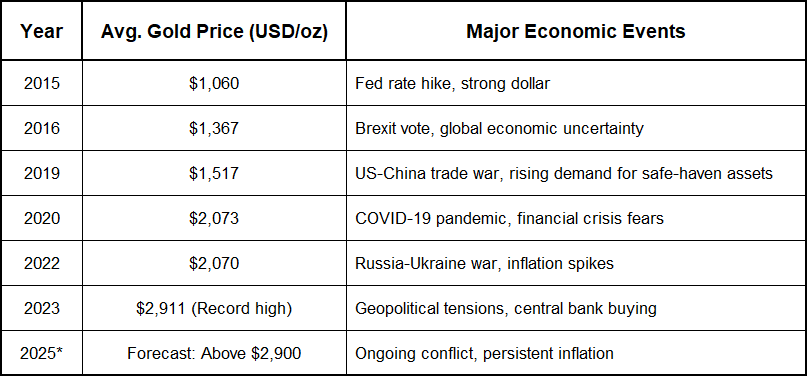

In 2015, gold was trading at $1,060 per ounce. Today, It's now approaching $2,900.

That’s nearly a 2x increase in just a decade—and many analysts believe it’s far from over. So, what's behind this sustained rally, and what should brands and investors prepare for next?

Let’s break down the key trends, global events, and expert forecasts shaping the future of gold.

A Decade of Growth: Gold Price Trends from 2015 to 2025

Over the past 10 years, gold prices have shown a consistent upward

trend.

Major milestones include:

Key patterns:

Gold often spikes during times of crisis (e.g. 2016, 2020, 2022)ends to decline when U.S. interest rates rise (e.g., 2015, 2021)

What Experts Say: Gold Price Outlook for 2025

“Can gold hit $3,000?” That’s the big question.

Many institutions believe it is possible.

City: Gold price could surpass $3,000 by 2025 ( Reuters )

UBS: Predicts $3,000 by end of 2024 (MarketWatch)

Wells Fargo: Expects $2,795 by 2025 (Korea Trade-Investment Promotion Agency)

Bottom line: If global instability continues, gold is likely to remain in high demand.

3 Core Drivers Behind the Gold Rally

1. Global Uncertainty Fuels Demand

Ongoing conflicts (Russia-Ukraine, Middle East) are pushing investors toward safer assets. U.S.-China tensions are also driving gold demand as a hedge against volatility.

2. Central Banks Are Buying More Gold

Countries like China, India, and Russia have been stockpiling gold. The U.S. dollar’s weakening influence is prompting central banks to diversify reserves. Experts note that continuous central bank buying may tighten supply and further drive-up prices.

Particularly impactful when central banks make unexpected additional purchases, triggering market reactions.

3. U.S. Interest Rate Policy

In 2022–2023, Fed rate hikes temporarily capped gold’s rise. However, if the Fed begins cutting rates in 2024 or beyond, gold prices could surge again.

Some analysts also believe a shift to long-term rate easing could signal a renewed rally in gold.

Conclusion: Will Gold Continue to Climb?

It depends on three main factors:

If global instability persists → gold will likely stay strongIf central banks continue buying aggressively → supply could tighten

If Fed policy pivots dovish → short-term spikes are possible

Key Takeaways for Brands & Investors

Gold is not just a metal—it’s a barometer of economic fear. For fashion or jewelry brands, understanding the movement of gold is critical to pricing, sourcing and planning . The next year or two could present significant opportunities for investors, but strategy is key.

“So how should we prepare now?”

Whether you're managing product pricing or planning your next investment, this

rising market demands a clear, forward-looking strategy.

Click here to download ARTE's company profile.

List

List